Home type is critical to determine the structural viability of homes after a fire.

Fire damage is the No. 1 insurance loss category nationwide and 80% were in residential structures. Kitchens are the prime location of origin. Commercial fire loss evaluation involves structural inspection and testing of wood, steel, concrete and masonry materials. Insurance carriers are seldom inclined to pay for post-loss structural testing and will attempt to settle claims based on visual observations. In extreme loss situations (i.e., “total loss”), this may be acceptable, but, in many cases, there is partial fire damage linked to the structural system. This article will share insight on the structural test procedures for evaluating fire loss claims and focus on coverage dispute issues as they pertain to insurance assertions of preexisting damage.

Forensic Engineer Fire Evaluation

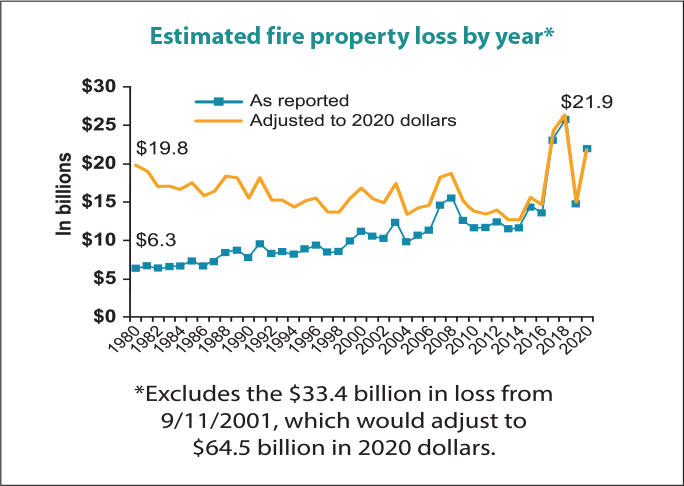

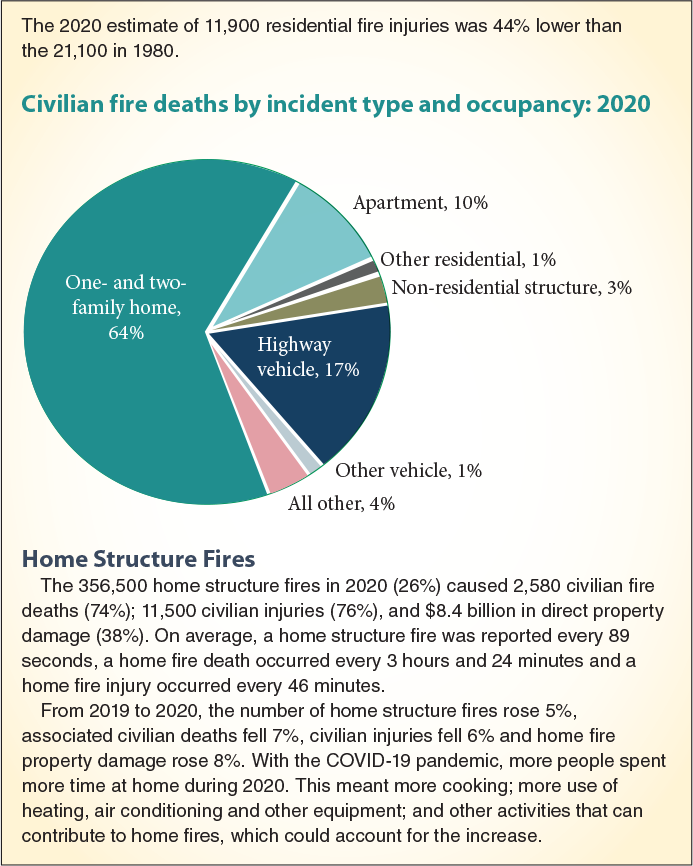

Fire losses account for approximately $22 billionDisplay footnote number:1 in 2020, with 3,500 civilian deaths. Forty percent of these losses were structure-related fires and the death toll is 64% attributed to residential one- and two-family dwelling units.

The 2020 estimate of 11,900 residential fire injuries was 44% lower than the 21,100 in 1980.

These facts point to the idea that the most dangerous place for fire deaths is at home, most likely due to fires originating in the kitchen area. Structure types drive these statistics. There are five categories of structures: Type I, II, III, IV and V. Each type is based on its resistance to fire. Type I and II are deemed the highest resistance with Type V the lowest. The simple definition is Type I and II are broadly classified as providing three- to four-hour fire ratings with materials of concrete, fire retardant encased steel and reinforced masonry. Type V buildings are wood-framed construction. Type IV is “heavy timber” construction which, although wood, has better fire resistance than conventional wood framing.

Of 195 countries in the world, the United States is the largest (perhaps only) purveyor of wood framed buildings that comprise 75-80% of our total floor space. All other countries, especially industrialized nations of the G7, use Type I, II and III construction. Even “developing countries” (Brazil, India, Mexico) rarely use Type V construction. This author is not an advocate for wood-frame buildings in areas that are susceptible to large fire loss. Think of California and the wildfires. Why does the fifth largest economy in the world rely on wood for their residences in wildfire zones? This is a mystery.

Figure 2: Excerpt from NFPA Report for 2020

For insurance adjusters, the tools to evaluate a fire loss and determine coverage are critically important. Insurance adjusters seek two critical objectives:

- Determine the full scope of the fire loss.

- Value the fire loss and reconstruction scope of work.

Insurance carriers may conduct these investigations with “traditional methods” of empirical valuation mixed with limited testing. Tests cost money, but they bring analytics to the insurance valuation process, which adds value to the process of estimation and scientific accuracy, which is necessary in the 21st century.

Four materials constitute civil engineering for the past 5,000 years: masonry, concrete, steel and wood. There are new versions of materials such aluminum, fiber composites, post tensioned concrete, etc. But these four basic materials are the building blocks of our civilization and wood is responsible for 75% of our building space in the United States. How should insurance adjusters approach fire loss evaluation?

I. Investigation

Fire loss investigations invest resources, time, testing and apparatus to determine the cause, origin and structural damage. For structural evaluations, a few tools beyond the visible eye are useful. These include both non-destructive testing (NDT) and destructive testing (DT) methods to assess the residual strength of materials.

Steel structures: NDT methods are X-ray, Ultrasonic Testing (UT) to examine the welds and bolts. Steel has a melt point of 2,600 F, and the fire proofing will last usually less than one hour. It’s imperative to examine residual strength of materials after the fire.

Masonry/Concrete structures: NDT methods are Schmidt Hammer for concrete compressive strength. DT methods are core extraction followed up with petrographic examination. NDT and DT methods will provide evidence of the remaining structural capacity and heat effects on steel reinforcement.

Wood structures: Wood requires testing in a lab by extracting samples (DT). Charring of wood members usually indicates lack of reuse and this impacts the replacement cost because code issues will raise the bar for the new design. Code upgrade is the most significant impact on Type V structures post-fire loss.

II. Structural Engineering Analysis

The structural redesign of the post-fire loss building must consider code upgrades, whether this is part of the coverage or not. The design engineer for the reconstruction must include this in their scope of work, although it may be separated out for cost valuation purposes. Certain carriers will demand that code upgrade design be excluded in the reconstruction plans purposely unless the building department demands them. This is an incorrect approach because the building authority is not the responsible party and is not liable to the owner for missing design elements that are required by code. The engineer of record is the responsible party and must include all design elements to satisfy the building code, whether the building department asks for it or not. Conflicts often arise on this point and insurance adjusters should be aware of this critical step.

III. Reconstruction Engineering with Cost Valuation

The reconstruction plan should follow through from Phase I and II to include all fire loss related items, code upgrade features and may trigger additional requirements that are required for the building permit. A few peripheral items that get triggered are the Americans with Disabilities Act (ADA) requirements that can be expensive, time consuming and require additional resources. ADA is a critical element on all post-loss reconstruction plans. Fire sprinklers are usually triggered in the reconstruction process. Upgrades to new roof materials and fire-retardant wrapping that was not in the original design may become cost additions.

Reconciling these additional costs with the insurance policy coverage is a prime challenge for insurance adjusters. Owners need to budget for the “true reconstruction” with building code upgrades, better materials, ADA, fire sprinklers and other elements that may not be covered under the policy but which they must pay for. It’s not the conversation anyone wants to have but needs to be done upfront and reconciled before the project starts, rather than surprising our clients with these additional expenses.’

Reprinted with permission from Napia.com.

Contact Clarke & Cohen for help with your property loss claim.