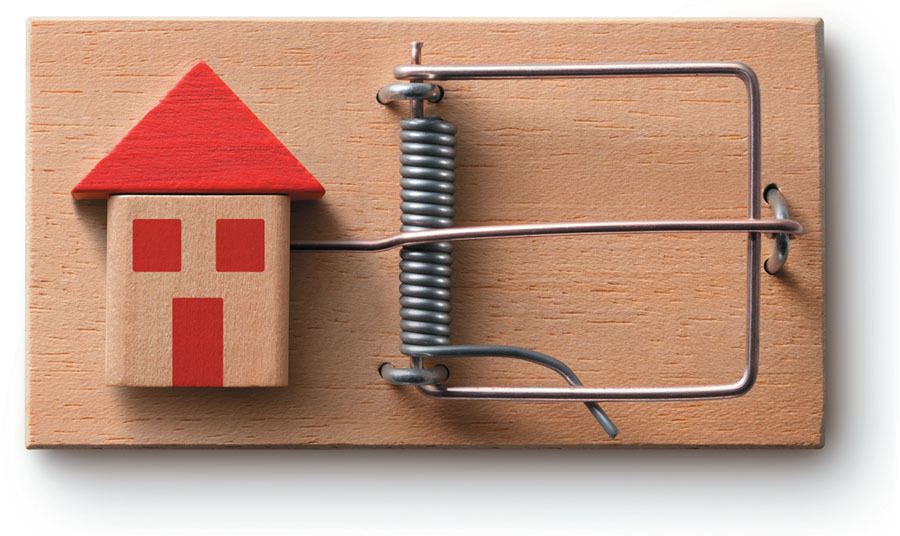

These factors mean insurance coverage may not provide the safety net that many assume.

What makes a coverage factor hidden?

Every professional that handles first party property claims is taught this simple and indispensable fact: an insurance policy is a contract. Contracts should clearly set forth the terms of the agreement in writing, so that duties and performance for each party are (reasonably) known and can be dutifully taken into consideration.

In a policyholder’s mind, their insuring agreement is a shield or a safety net that hedges against fortuitous risk. Simply reading their policy should give the policyholder an opportunity to reasonably determine possible coverage gaps. However, in my work as a public insurance adjuster advocating for policyholders, I have found many risks to coverage that are hidden or disguised. I consider coverage factors hidden when they are challenging or nearly impossible for a policyholder to have access to, or be aware of to assess coverage pre- or post-loss.

The following examples contribute to a large share of claim issues or disputes, often to the detriment of the policyholder.

“Most insurers will refuse to release a copy of their claims handling guidelines to a policyholder, in some cases even resisting discovery requests for them in litigation. This is concerning, as the idea of the insuring agreement is that both parties can reasonably determine coverage, per the contract.”

Hidden in plain sight: coverage factors before a claim

Most states require policies to be written in plain language, with some statutorily employing the “Flesch scale analysis readability score” as a guide. Even with these well-meaning requirements, I have had attorney policyholder clients who found understanding their policy and coverage a challenge, as property insurance was not within their law practice. Many policyholders do not possess the base knowledge necessary to truly understand their policy. I haven’t heard of insuring basics being taught in school, without being a part of an insurance-related degree, have you?

In addition, insurer advertising is a primary source of policyholder insurance education. The focus of most of these advertisements are: “Save money on premiums!” and “We’ll protect you!” I certainly never thought to read a policy until I entered this profession. “I never thought to read my policy. I don’t know why!” is something I hear from most of my policyholder clients. After all, who would even think to read their policy or assess possible coverage gaps? They have the safety net they were promised through hundreds of hours of insurer advertising and possibly saved money on their premiums.

All of this can lead to coverage factors before a claim being hidden in plain sight.

I recently reviewed a premium discount offer from a policyholder’s insurer. It was titled “Impact-Resistant Roof Discount.” According to the letter, if they replaced their current roof with an impact-resistant asphalt shingle they would receive “a premium discount.” The letter did not state what the actual premium discount would be, nor was there any phone number or suggestion in the letter of who to contact to find out: only “Sign and mail your forms to the address above or fax them to …” The policyholder called the insurer’s customer service number they found online and learned that the discount would be $220.23.

In order to get this discount, the letter stated:

“How do I get the discount? If you have an impact-resistant roof, you must submit the following form(s) we’ve included to get the discount: […]

Cosmetic Damage Exclusion form (Do not return this form if your property is in Kansas, Indiana, Louisiana or Virginia). By signing this form, you agree that in return for the discount, you will not have coverage for cosmetic loss or damage that’s caused by hail and alters the appearance of the roof covering. You will have coverage for hail damage that allows water to penetrate the roof covering.”

Cosmetic damage exclusions are an increasing coverage gap and are becoming a large source of claim disputes and litigation. Shortly after my review, the policyholders paid $17,262.19 for their planned, retail roof replacement, but they did not move forward with the policy discount offer. It would have meant accepting a $220.23 discount for a possible $17,000.00 or more coverage gap. The policyholder told me: “We wouldn’t have known to even check this if our neighbor hadn’t referred you, Sarah!”

Now that we’ve covered a pre-loss example of a hidden or disguised coverage factor, let’s dive into the claims process.

Are claims handling guidelines best practices or disguised extra-contractual coverage limitations?

Claims handling guidelines are an insurance claim department’s playbook. They can be a way to standardize claim handling and coverage decisions, especially when faced with external variables to coverage that may not be directly addressed in the policy.

On the one hand, standardization can be a good thing, lending to consistency in treatment of policyholder clients, lessening the burden and time spent making decisions and — hopefully — general operations efficiency. Yet, claims handling guidelines can be used to wrongfully deny or underpay claims in conflict with the coverage provided by the policy terms. When this happens, claims handling guidelines can arrest and inhibit the proper application of the basic tenet of all property insurance: indemnity.

Per one insurer’s claims guidelines, they will under no circumstances provide coverage in hail and wind losses for pre-loss reasonable uniform appearance, age or condition for an asphalt shingle roof unless the roofing material is discontinued and no longer available. These guidelines do not have the same restrictions for other, much more costly exterior items. These seemingly arbitrary coverage determinatives are not present within in the policy. Most insurers will refuse to release a copy of their claims handling guidelines to a policyholder, in some cases even resisting discovery requests for them in litigation. This is concerning, as the idea of the insuring agreement is that both parties can reasonably determine coverage, per the contract. Why is it acceptable for an insurer to use hidden coverage determinations, unilaterally or arbitrarily? This is a common occurrence in property insurance claims nationwide.

Hidden coverage wildcard: adjuster training

Adjuster training is an increasing threat to coverage. Having worked alongside many different insurers, I have found great variance when it comes to the effort each invests in training its adjusters and claims staff. This could be one of the more confounding hidden coverage variables for policyholders, and insurance and legal professionals alike.

For most states, public and independent adjusters are required to be licensed, and to complete pre-licensing training that includes the basics of contract law, and principles to follow when determining coverage for a claim. Insurance company staff adjusters are not required to be licensed in many states, and therefore it is not known if they receive the same training that pre-licensing requirements cover. To illustrate my concern, here is a quote from a phone conversation I had with a staff adjuster, who was in a call center over a thousand miles from my client’s loss: “I don’t know about your state’s claim handling laws, and I don’t need to read the policy. My job is to follow the claim guidelines.” This has happened more than once.

Considering what we’ve covered so far — lack of policyholder knowledge and possible misapplication of claims guidelines — how do we know if coverage is properly determined in a claim if both the adjuster and the policyholder lack the necessary training for this complex subject?

Conclusion

Hidden coverage factors are by no means new in claims adjusting, and nor are the disputes that can arise from them. The reality that these are in fact evolving factors, increasing in occurrence, lends to the exploration that these are directly and intentionally influenced. I feel that the outcomes of these are unfairly detrimental to policyholders based on the number of wrongful claim denials and inadequate settlement offers I successfully overturn in my work.

While there is perhaps no immediate remedy to these hidden coverage issues, public awareness is a good start. The coverage battles at hand are currently cloistered with the professionals engaged in them. They break the surface for public view occasionally in news headlines, only to be drowned out and forgotten within the soothing messaging of insurer advertising.

These evolving hidden coverage factors, ever-increasing premiums, and new exclusions and limitations are resulting in record diminution of coverage. The benevolent insurance safety net we are conditioned to believe in, and give our uncompromising trust to, could very soon be on its last threads.

By

Reprinted with permission from Napia.com

Original article

Contact Clarke & Cohen with questions about your property insurance claim/policy.