Navigating Business Interruption Insurance

Ensuring Stability for Your Business with Clarke & Cohen Public Adjusters

Picture this: your business is thriving, operations are running smoothly, and suddenly, disaster strikes. A severe property damage incident occurs, leaving your business paralyzed.

How can you continue paying your employees and covering expenses during this challenging time? That’s where business interruption insurance steps in, and Clarke & Cohen Public Adjusters is here to guide you through this process.

Understanding Business Interruption Insurance

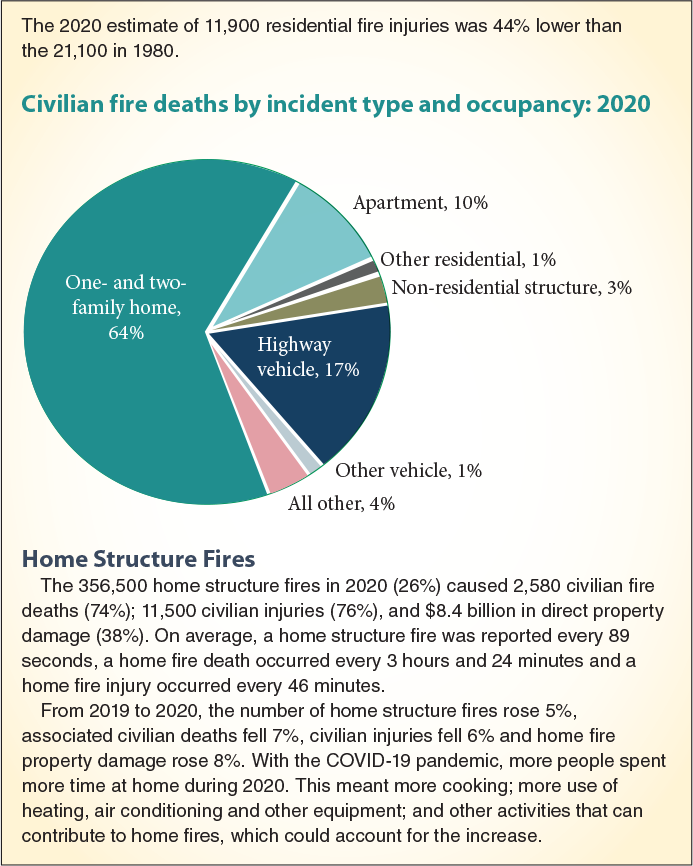

Business interruption insurance is a vital component of any comprehensive risk management plan. It is designed to protect businesses from the financial fallout that occurs when they are forced to halt their operations due to property damage caused by a covered peril, such as fire, water damage, or certain natural disasters. This type of insurance coverage helps ensure that your business can continue to pay its key employees, meet other payroll obligations, and cover ongoing necessary expenses during the restoration and recovery period. It may also cover emergency and ongoing extra expenses that occur such as temporary work locations and marketing and advertising to help your customers find you.

Securing Stability for Your Employees

Your employees are the lifeblood of your business, and ensuring their financial stability during a crisis is paramount. Business interruption insurance allows you to continue paying your employees, ensuring that they can meet their personal obligations while you work towards getting your business back on track. The policy provides coverage for employee wages and benefits based on their pre-interruption earnings, helping to ease the burden on both your staff and your company.

At Clarke & Cohen Public Adjusters, we understand the importance of maintaining a supportive and motivated workforce during a difficult period. Our team of experienced professionals will work closely with you to assess the impact of the property damage incident on your business and ensure that your employees’ financial well-being is prioritized.

Continuing to Cover Business Expenses

When disaster strikes, the bills don’t stop. From rent and utility payments to loan installments and supplier invoices, your business still has financial obligations to meet, even if operations are temporarily suspended. Business interruption insurance provides coverage for necessary expenses that your business would typically incur. This will ensure that you can keep up with your financial responsibilities during the restoration period.

Clarke & Cohen Public Adjusters dedicated team is well-versed in navigating the intricacies of business interruption claims. We will meticulously assess your business’s expenses and work diligently to negotiate with insurance carriers to maximize your coverage. We will also work hard for you to secure the funds needed to sustain your business operations throughout the interruption period.

Proving Business Interruption Losses

When it comes to making a successful business interruption insurance claim, meticulous documentation and accurate financial records are crucial. Clarke & Cohen Public Adjusters understands the complexities involved in proving business interruption losses. Our team will help you compile all the necessary documentation. This includes financial statements, tax records, and other supporting evidence, to substantiate your claim and ensure that you receive fair compensation for the losses you have incurred.

Navigating the Claims Process with Clarke & Cohen Public Adjusters

The claims process can be overwhelming, especially during a time when your focus should be on restoring your business. That’s where Clarke & Cohen Public Adjusters comes in. Our expert team specializes in handling business interruption insurance claims and will serve as your trusted advocate throughout the entire process.

We will conduct a comprehensive analysis of your policy, ensuring that you understand the coverage and limitations in place. Our adjusters will assess the extent of the property damage, evaluate the financial impact on your business, and carefully calculate your losses. With our vast experience and in-depth knowledge of insurance policies, we will negotiate with the insurance company on your behalf, working tirelessly to secure the maximum compensation you deserve.

Business interruption insurance is an essential safeguard for every business owner. It ensures that your employees are taken care of and that your business can weather the storm during times of property damage and operational disruption. Clarke & Cohen Public Adjusters is committed to supporting you through these challenging times, offering the expertise and dedication needed to navigate the complex world of business interruption insurance claims successfully.

Don’t face the aftermath of a severe property damage incident alone. Contact Clarke & Cohen Public Adjusters today, and let us be your trusted partner in securing the stability and financial well-being of your business. Together, we’ll overcome the challenges and emerge stronger than ever before.